How a Seller sets up the Buying Committee with 6sense

This article presumes you already know the following:

- Buying Committees are not new; selling enterprise solutions has involved multiple stakeholders for decades. Stories about deals closed based on a personal relationship with the Economic Buyer, dinner, or golf, were exceptions, not the rule.

- Buying Committees are not consistent across organizations. The roles that make up a buying committee in one company can look very different in another, even if both companies share a lot of characteristics (size, revenue, industry, location, etc.).

- Buying Committees are rarely fixed at the outset. Sure, there are companies that assemble a cross-functional group of people to go out and evaluate a solution for x with an RFP, score cards, and a project plan, but more often, the group is assembled ad-hoc as those in the evaluation in the beginning figure out who else they need buy-in from to procure the solution. What you think the buying committee looks like a month into a buying cycle usually looks very different three months in.

Ultimately, you as the salesperson need to figure out who is in the Buying Committee for every opportunity you're working. Marketing can try to help, automation can try to help, but ultimately, it's the seller's responsibility to figure out who to navigate the prospect's organization to obtain a signature.

How Marketing and/or RevOps can help

There is very likely a persona or two that is involved in every single Closed-Won deal because their job(s) are affected the most by the solution. At 6sense, for example, almost every deal will involve someone from Demand Generation. Secondarily, someone from Marketing Operations (MOPS) is often involved.

Beyond those roles, though, deals differ drastically. Sometimes Sales is involved in the presales process, and sometimes they aren't at all. Sometimes Sales Ops (SOPS) is involved, often not. Sometimes IT is involved, sometimes not. Same with Sales Enablement. The Head of Marketing (CMO, SVP or VP Marketing) are almost always involved by the end. Obviously Legal and Procurement are involved in the final Ts & Cs, but they are aren't really part of the "decision-making process" so much as finalizing terms and mitigating risk.

Marketing/RevOps can —and should— pre-purchase Contacts from 6sense for the persona or two or three that are in almost every single deal. That part of the buying committee can be "built out" automatically with the best information 6sense has on the people in those roles and their contact information. Beyond that, though, it's best to let Sales fill out the Buying Committee based on what they learn once they're in an active opportunity.

How Sales can use 6sense to build out the rest of the Buying Committee

Beyond those sure-fire personas you find in every deal, sellers need to take the lead on filling out the Buying Committee as the deal progresses. Most seasoned sellers will want to keep the buying committee as small as possible to limit the number of potential detractors, but they'll often also want to bring in other personas when they know their solution shines with that group. For example, if you know IT departments tend to prefer your solution over your competitor's, you'll want to try to bring IT into the deal as early as you can. 6sense can help. LinkedIn Sales Navigator can also help.

Where to start within 6sense?

Your buying committee detective work should start within 6sense's Persona Map. The first thing you should look for is recent engagement from known contacts. Are there people who are being identified by name as visiting your company's website, clicking on email blasts, registering or attending webinars or events, or anything else that might indicate interest? Activity from these individuals does not necessarily mean they are part of the buying committee, but it's highly likely they are, and it may be worth reaching out to them to see what you can find out.

Once you've exhausted signals from known contacts, anonymous activity can be examined. Use the geo-location information for web visits and keyword research to see if you can deduce anything based on where the activity is coming from. If it's from the headquarters city, it's going to be nearly impossible to figure out who may have been doing the research. But if you can find another slightly more obscure city, using LinkedIn Sales Navigator, you can sometimes make a very educated guess about who was doing what. It is an imperfect science, for sure, but it's better than being in complete darkness.

Finally, if your company has 6sense's predictive models, the color coding in the Persona Map will help direct your attention to the department/seniority combinations that are most likely to be engaged leading up to an opportunity. Contacts in the darkest blue boxes are where you should start, then the lighter blue, and you likely don't need to waste your time on folks in the lightest blue.

Using LinkedIn Sales Navigator to help

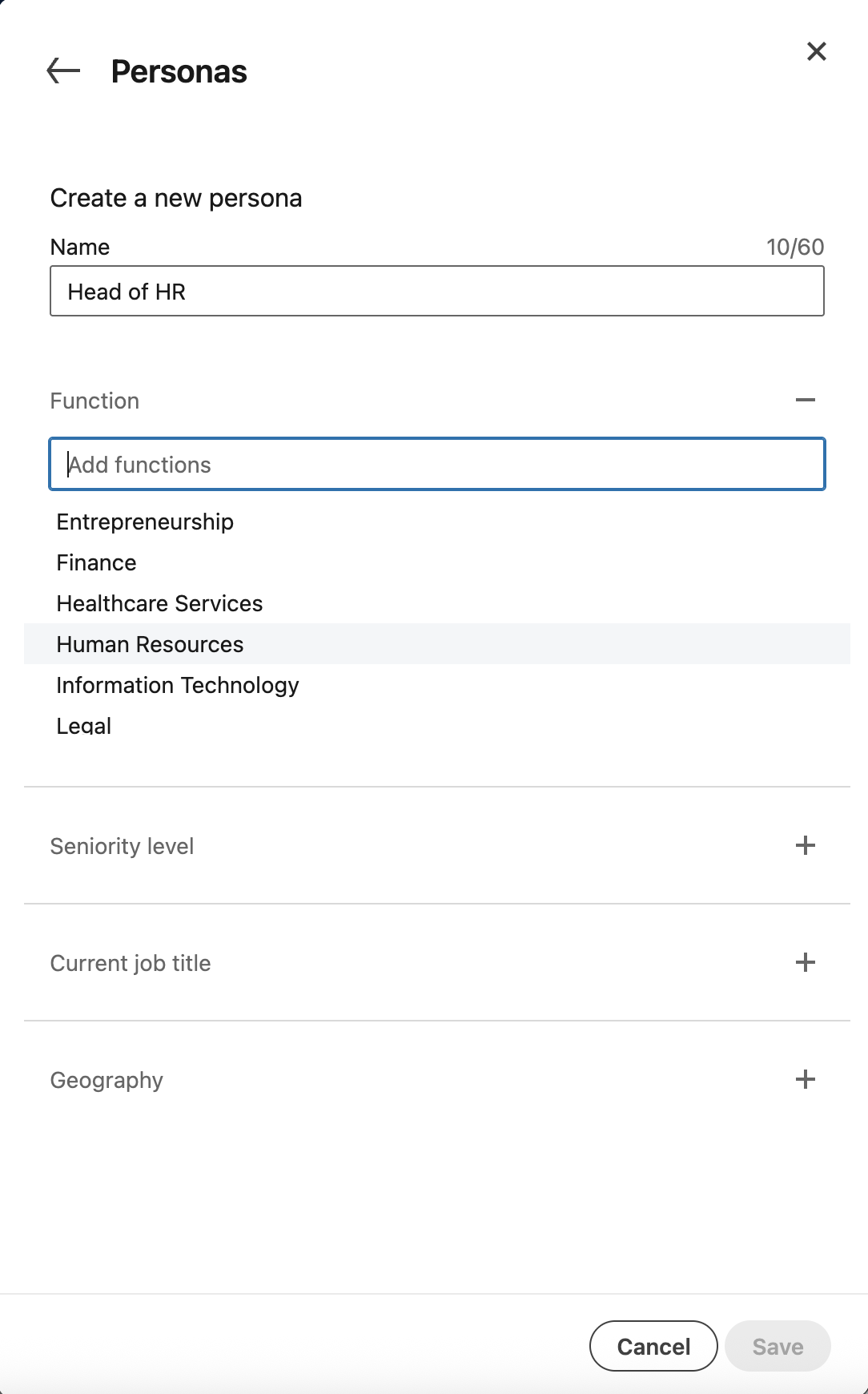

As we always say, there is no better source, currently, of where someone works and what they do than LinkedIn. Nobody emails the various contact data vendors on the market to update their place of employment and provide an email address for cold emails, but almost everybody does go to LinkedIn to update their profile when they get a new job or promotion. Using saved Personas is a quick way to narrow down the people you might want to talk to within an account you are prospecting into.

The same goes for narrowing down the anonymous person or people that were on your website or conducting keyword research. While 6sense has Contact Location for millions of people, it will never be as accurate as LinkedIn since people are proactively sharing where they live with LinkedIn.

Back to 6sense for Contact Information

At the same time, it is rare that LinkedIn has contact information for the people you find. Sometimes it does, and it's always worth a click to check! After all, if the person has put in their own email or phone number, chances are it's correct. But most people don't share that information, especially with people they are not connected to. This is where 6sense can help. Ideally, 6sense has a mobile number for the person since that tends to persist beyond jobs. Hopefully, there's an email address as well. If not, click on another profile or two of people that work for the same company to deduce their email address pattern (e.g. firstname.lastname@xyz.com).

Back to LinkedIn for multi-channel touches

Assuming you've crafted your best emails to no avail, and you've hit the phones a few times trying to get the attention of your potential buyers, you may consider going back to LinkedIn for some good old fashioned social selling. Could be an InMail. Could be a connection request. Could be reacting to, or commenting on a post of your target persona. There are better resources than this article for LinkedIn social selling best practices, but just know that sellers that use multiple different channels to get their prospect's attention (email, phone, social) outperform those that use just a single channel.

Categories

- All Categories

- 20 Maturity Model

- 5 Groundwork Use Case Playbooks

- 7 Transform Use Case Playbooks

- 6 Maximize Use Case Playbooks

- 1 Roadmap

- 1 Crossword

- 733 All Discussions

- 55 Product Updates

- 61 6th Street

- 12 Welcome

- 4 Administrator Certification

- 3 Sales Certification

- 10 Advertising Certification

- 10 Demand Gen Plays

- 21 Reporting HQ

- Business Value Assessment (BVA)

- 38 AI Email

- 3 What is CE

- 8 Getting Started with CE

- 16 Thriving with CE

- 6 Conversation Starters

- 203 Job Board

- 34 General

- 11 Partner Place

- 199 Research Road

- Compensation Calculator

- 79 Sales

- 14 Pipeline Generation Tuesdays

- 20 BDR Block

- 11 SKO Supplies

- 7 Advice

- 2 Assets

- 20 Verticals

- 10 Manufacturing, Logistics & Supply Chain

- 8 Financial Services

- search-results

- 291 Events

- 12 6sense Quarterly Product Update (Recordings)

- 26 Customer Story Hour (Recordings)