Metric Monday: Marketing-Sourced and Influenced Metrics

For quite some time, organizations have wrestled with the challenge of quantifying marketing’s impact on revenue generation. Traditionally, two distinct strategies have been employed:

1. Marketing-Sourced Metrics: Attempt to identify which deals and their associated revenue were first identified or engaged through a marketing activity.

2. Marketing-Influenced Metrics: Attempt to measure which deals that are not claimed as sourced by marketing were nonetheless touched at some point by marketing tactics.

Unfortunately, both approaches are marred by subjectivity, questionable claims, and, in the case of marketing-influenced metrics, irrelevant assertions about when a deal was identified, activated, or influenced by marketing.

Marketing-sourced metrics have faced growing scrutiny in recent years for their tendency to both underestimate and overstate marketing's involvement in identifying selling opportunities. The challenge of determining who sourced or initiated first contact for a given deal is virtually impossible. And, in sales cycles that last months and quarters, the answer is not likely helpful.

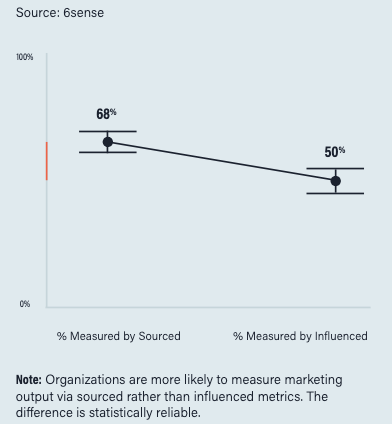

Last year, 6sense Research surveyed nearly 400 B2B practitioners to understand whether marketing organizations are adapting their measurement strategies to align with the reality of B2B buying and selling. Survey answers showed us that organizations predominantly favor measuring marketing output through sourced metrics over influenced metrics.

-On average, organizations employ 4 to 5 sourced metrics and 2 to 3 influenced metrics.

- 68% of measurements (such as pipeline opportunities and early-stage opportunities) are reported as sourced, while 50% reflect influence.

- Among those utilizing marketing-sourced metrics, first-touch, last-touch, and multi-touch approaches are equally popular, with statistically-determined lagging well behind.

These findings highlight the ongoing challenges in accurately assessing the impact of marketing on revenue, prompting the need for organizations to evolve their measurement strategies to better align with the complexities of B2B buying and selling dynamics.

Comments

-

We're going to be checking in with you all via survey soon to see how things are looking this year. My experience tells me that everyone is still really struggling with this. We'll be talking more about what we should be doing instead, but here are a couple ideas:

1. Evaluate marketing tactics for the job they are intended to do. This requires that every marketing tactic have a job. Is it meant to move a buying group over the line to a purchase, or just to get them to the website engaging? Is it educational? Is it competitive positioning? Then, how well does each tactic do its job compared to other tactics for that job?

2. If you measuring sourced but not using anonymous web traffic to identify the actual first interactions, you're going to be off target by a lot.

But, if you try to claim sourced based on anonymous traffic, sales isn't going to look kindly on that.

So, we need to focus more on looking at it as: How did we first notice this buyer? Which accounts have buying groups, rather than just individuals who are engaging. How does buying group engagment relate to opportunity production? Which accounts had the most engagement, and did that engagement lead to better results down the line?6 -

As an org we moved away from sourced a long time ago. It was too hard to do a 1:1 correlation because we do a LOT of marketing activity. We have an influence-only system that is completely automated. Our assumption is that if the account has a contact associated to a marketing campaign that is active when the opportunity is created, even if there is no direct correlation between that particular campaign and the opportunity, there's still a level of marketing influence.

Example: Company A has 3 people who attend a webinar on New Product and 2 who attend a local event on Service Offered. The rep is talking to the account and they end up renewing their Existing Product with no services while those campaigns are still active. The opportunity is still noted under both campaigns and the influence is split 3/5 and 2/5 respectively. The idea being that even though the opportunity is not the products or services we were presenting, the prospect still interacted with us in a meaningful way (meaning - influence).

4

Categories

- All Categories

- 20 Maturity Model

- 5 Groundwork Use Case Playbooks

- 7 Transform Use Case Playbooks

- 6 Maximize Use Case Playbooks

- 1 Roadmap

- 1 Crossword

- 734 All Discussions

- 55 Product Updates

- 61 6th Street

- 12 Welcome

- 4 Administrator Certification

- 3 Sales Certification

- 10 Advertising Certification

- 10 Demand Gen Plays

- 21 Reporting HQ

- Business Value Assessment (BVA)

- 38 AI Email

- 3 What is CE

- 8 Getting Started with CE

- 16 Thriving with CE

- 6 Conversation Starters

- 203 Job Board

- 34 General

- 11 Partner Place

- 200 Research Road

- Compensation Calculator

- 79 Sales

- 14 Pipeline Generation Tuesdays

- 20 BDR Block

- 11 SKO Supplies

- 7 Advice

- 2 Assets

- 20 Verticals

- 10 Manufacturing, Logistics & Supply Chain

- 8 Financial Services

- search-results

- 291 Events

- 12 6sense Quarterly Product Update (Recordings)

- 26 Customer Story Hour (Recordings)